Integrated / Enterprise Risk Management System

PT. Klickers's Integrated Risk Management System (IRMS) provides speed, conveniences, real-time accuracy and security in consolidating as well as tracking or submission of the scoring of the organization-level risks. IRMS can be applied not only to financial conglomeration and banks but to various other industries and organization to track it's enterprise or organizational risks. It's flexible and can be further customized to suit any needs within any organization.

On the banking industry, in 2014 the Financial Services Authority / Otoritas Jasa Keuangan (OJK) issued a regulation number 17/POJK.03/2014 concerning the implementation of integrated risk management for financial conglomerates in Indonesia. With various companies running across different financial sectors and different nature of business need to be incorporated into a conglomeration, this has increased the complexity of data-sharing, interactions and consolidation among the companies / financial services institutions (LJK) within such financial group, usually resulting in the time-consuming, inaccurate and inefficient processes.

In an effort to implement this, there are several challenges that may be encountered by the organization due to the reasons mentioned above.

- Lack of tools to consolidate, track and submit the scores. This could lead to repeated revisions, inaccurate results, ineffective communications and perhaps late in reports submission.

- Tracking scores is cumbersome and this activities take a very long time and inefficient.

- Efforts are needed to just consolidate a minor revision from one of the scores as they all need to be consolidated again and this is very prone to errors.

Our IRMS has been implemented and used by various banks with further specific enhancements to support their needs.

Some of our Features:

- Comprehensive Management of Risk Indicators.

- Powerful and Flexible Workflow Approvals

- Dashboard dan Tracking Report

- Report Generator

- Data Source Connector

- Customizable Platform / Solutions

- Unlimited Management Organization / LJK - for group scoring consolidation.

- Experts Judgments to overwrite any scores.

- And many more...

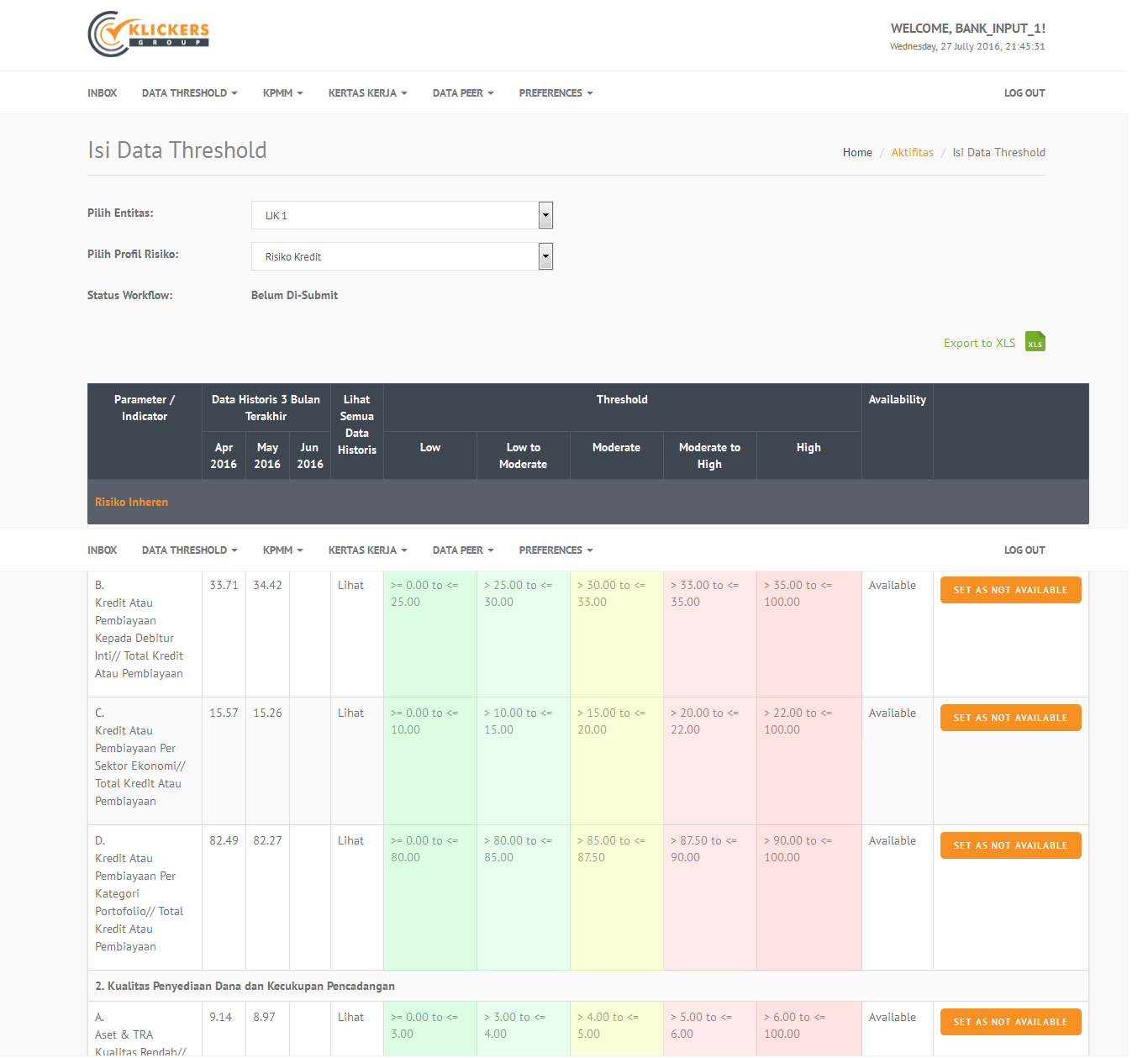

IRMS supports and allows the user to maintain the set of risk indicators with its thresholds. It supported various indicators ie ratio, whole number and qualitative.

We have also supported 10 (ten) risk profiles as requested by the regulators. Additionally, our tools can also be used to measure any other additional (internal) risk profiles that your organization required according to any of the business needs and requirements.

1. Credit risk

2. Market risk

3. Liquidity risk

4. Operational risk

5. Legal risk

6. Reputation risk

7. Strategic risk

8. Compliance risk

9. Risk of intra-group transactions

10. Insurance risk

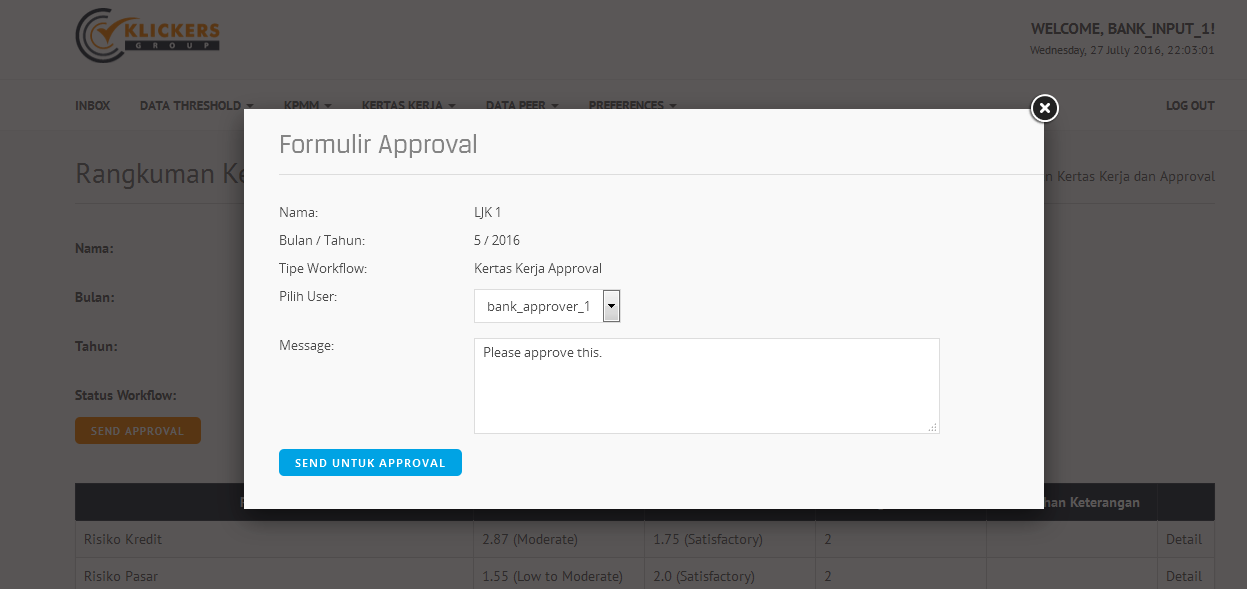

Through the workflow admin features, IRMS allows a very flexible workflow approval which can be customized and defined for every single risk profile submission.

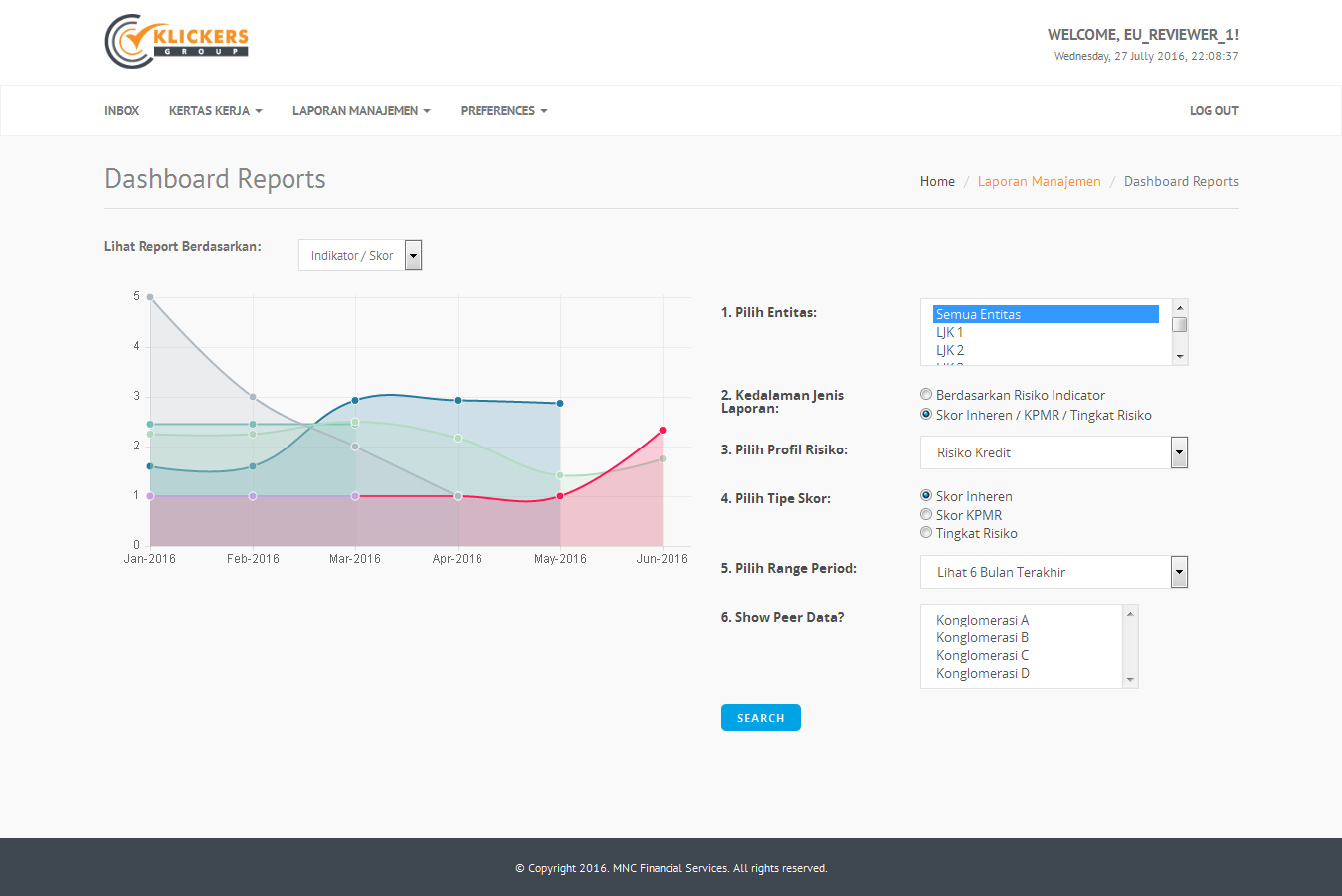

You can easily search for reports that you needed, through a graphical data, or even scan through all the working papers that contributes towards the consolidated scores. It saves you significant time compared to manually search the data manually.

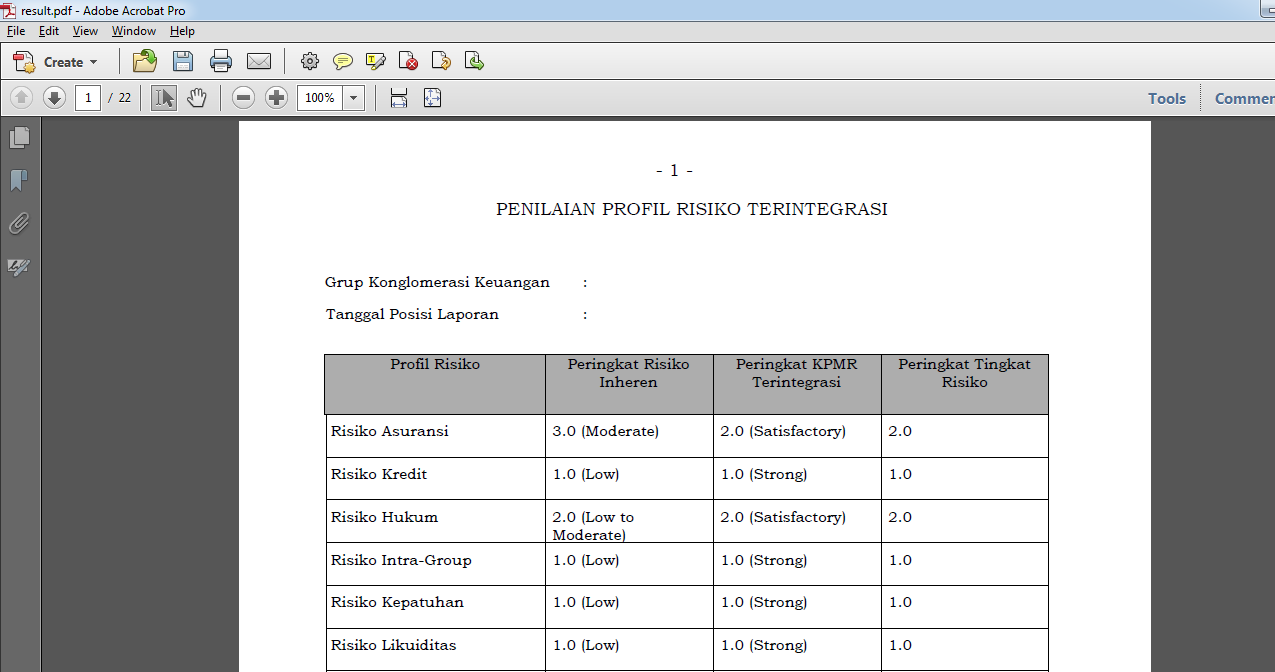

IRMS can generate a report form that is required by regulator via just a click of a button. The report template can further be customized to your internal needs.

We have provided an Excel file as the medium for the data sources to working paper within IRMS especially for those indicators that are quantitative. However, our tools can further be customized to integrate with any other data source providers within the organization.

Most importantly, not only facilitating all the features above, IRMS is a very flexible platform that can further be customized / developed to support customizations / additional features according to your needs. This helps to ensure that the IRMS is the right solution can fully fit to the existing processes within your company.

Feel free to contact us to know more about this product. Don't forget to also check on our various other products ie Operation Risk Management (ORM) and Credit Risk Management System (CRMS).